This report examines the Housing Solutions Fund’s impact in Missoula, focusing on spending patterns, prevention efforts, and equity. Key findings highlight strengths in stabilizing housing for at-risk populations and opportunities to improve funding diversity, equity, and support for unhoused individuals.

Executive Summary

The Housing Solutions Fund plays a critical role in addressing homelessness and housing instability in Missoula by allocating resources to both prevention-focused interventions and support for individuals who are already unhoused. This report provides a detailed analysis of fund utilization, highlighting spending patterns, demographic insights, and the impact of diverse funding sources. Key findings demonstrate the program’s dual focus on immediate housing stabilization and upstream preventive measures, while also identifying gaps and opportunities to improve equity and sustainability.

A significant portion of funding is allocated to rent payments and deposits, reflecting the program’s emphasis on stabilizing housing for individuals and families at risk of eviction or displacement. Prevention-focused spending accounts for the majority of resources, surpassing allocations for individuals who are already unhoused. This strategy aligns with best practices in homelessness intervention, prioritizing cost-effective solutions to reduce the long-term demand for crisis services.

Demographic analysis reveals that single, non-elderly households receive the largest share of funding, while certain racial and household groups, such as Black or African American households and two-parent families, are underrepresented. This suggests a need for improved equity in resource distribution. Additionally, the Affordable Housing Trust Fund (AHTF) emerges as the dominant contributor, funding a wide range of recipients, including the Missoula Housing Authority (MHA), which receives the largest share of resources. However, reliance on AHTF highlights the importance of diversifying funding sources to ensure long-term sustainability.

This report offers several recommendations to enhance the fund’s impact. First, shifting more resources toward smaller, underfunded categories, such as utility assistance and transportation, could address key barriers to housing stability. Second, improving outreach and access for underrepresented racial and household groups would promote greater equity. Lastly, expanding partnerships with private donors and smaller funding sources would reduce dependency on AHTF while maintaining the program’s capacity to meet growing demand. These strategies aim to strengthen the Housing Solutions Fund’s ability to provide equitable, effective, and sustainable support for Missoula’s most vulnerable populations.

Introduction

The Housing Solutions Fund is a foundation of Missoula’s efforts to address housing instability and homelessness. By providing financial support for rent, deposits, arrears, and other essential services, the fund seeks to stabilize housing for vulnerable populations and prevent individuals and families from falling into homelessness. Administered through diverse funding sources, the program targets both prevention-focused interventions and support for those already experiencing homelessness.

This report explores how the Housing Solutions Fund has been utilized over recent years, focusing on spending patterns, demographic distributions, and the role of funding sources in addressing the city’s housing challenges. It examines how resources are allocated across spending categories, such as rent, deposits, and utilities, and evaluates the balance between prevention-focused spending and assistance for those who are already unhoused. Additionally, the report assesses whether certain demographic groups or household types are underrepresented in fund utilization and analyzes how funding contributions and spending trends have evolved over time.

Through this analysis, the report uncovers insights that can guide future resource allocation and ensure the fund’s sustainability and equity in addressing the growing needs of Missoula’s unhoused and at-risk populations. The goal is to provide actionable recommendations to improve the Housing Solutions Fund’s ability to serve Missoula’s most vulnerable residents. By addressing gaps in equity, diversifying funding sources, and optimizing resource allocation, the fund can continue to play a pivotal role in creating sustainable solutions to housing instability in the community.

Results

Spending Patterns by Purpose

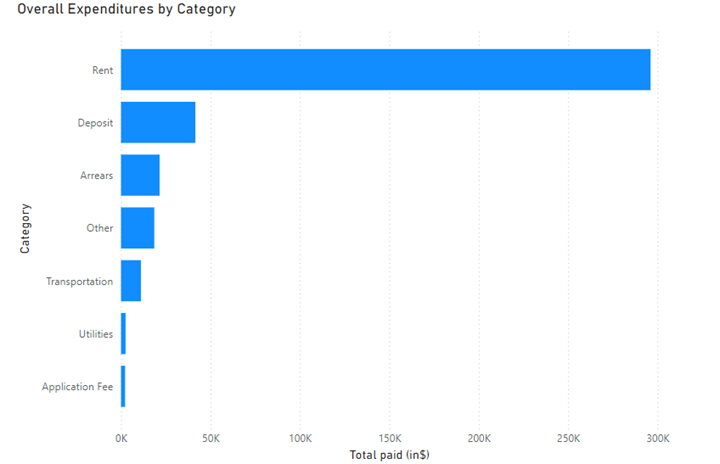

The chart in Figure 1 provides a clear view of how the Housing Solutions Fund prioritizes spending across major categories. Rent expenditures dominate the total allocation, exceeding $300,000. This substantial investment underscores the program’s focus on addressing the immediate housing crises of individuals and families, preventing evictions, and ensuring stable housing situations for those facing financial difficulties. Rent spending is often critical in stabilizing households on the verge of displacement, particularly as rent-related payments represent the most pressing and immediate needs for housing stability.

Deposits, the second-largest spending category at over $45,000, reflect the fund’s proactive efforts to secure housing for individuals transitioning into new living arrangements. These payments often cover security deposits or other upfront costs required to enter stable housing, particularly for individuals experiencing homelessness or those at imminent risk. By investing in deposits, the fund facilitates housing access for vulnerable populations who might otherwise face insurmountable barriers to securing permanent shelter.

Arrears, the third-largest category, represent a smaller but still significant share of the fund’s spending. These payments help individuals and families address past-due rent or other housing-related debts that, if left unresolved, could result in eviction or long-term housing instability. By covering arrears, the program prevents individuals from entering the homelessness cycle, aligning with its broader strategy of prevention.

While rent, deposits, and arrears dominate the spending patterns, smaller categories such as transportation, utilities, and application fees also receive allocations. These expenditures, though less prominent in total dollar amounts, play a vital role in addressing specific barriers to housing stability. Transportation assistance, for example, can help individuals secure employment or access temporary shelter. Utility payments prevent service disconnections that might otherwise render a home uninhabitable, and application fees remove a potential hurdle for individuals seeking housing in competitive rental markets. These smaller expenditures may represent fewer total dollars but are often instrumental in enabling individuals to maintain or access stable housing environments.

The consolidated spending categories reveal the dual focus of the Housing Solutions Fund. On one hand, the program prioritizes addressing immediate housing crises through rent payments and arrears. On the other, it invests significantly in preventive and enabling measures, such as deposits and ancillary support services. However, the overwhelming share of the budget allocated to rent expenditures suggests a heavier emphasis on reactive, crisis-oriented spending. While this is vital for stabilizing households in immediate distress, it may highlight an opportunity to increase investments in preventive measures like utilities and application fees, which could reduce the need for larger, reactive expenditures in the future.

Figure 1 Overall Expenditures by Category: Rent dominates spending, with significant investments in deposits and arrears, while smaller allocations address barriers like utilities and transportation.

Distribution: Prevention vs. Literally Homelessness

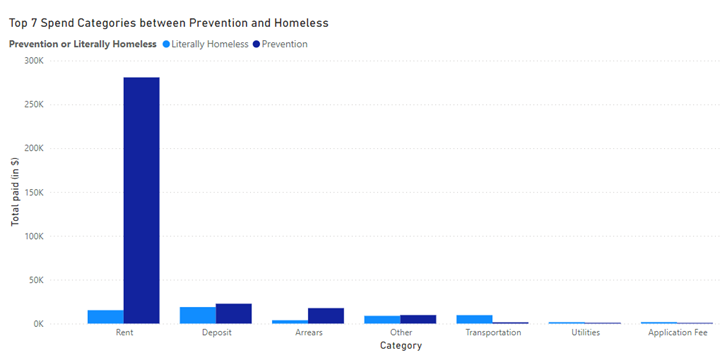

The graphs Figure 2 and 3 provide critical context for understanding the allocation of resources between prevention and literal homelessness support. Contrary to the initial perception that the program’s spending is predominantly reactive, the data reveals a clear prioritization of prevention-focused funding. This emphasis is reflected in two key ways:

The Figure 2 chart highlights that rent dominates spending, with over $250,000 allocated primarily to prevention efforts. This prioritization reflects the program’s focus on stabilizing housing for at-risk households. Deposits, the second-largest category, also target prevention by assisting individuals in securing stable housing. Arrears funding, while smaller, similarly leans toward prevention, helping resolve debts that could lead to eviction.

Smaller categories, such as transportation, utilities, and application fees, receive less funding but play crucial roles in addressing barriers to housing stability. These expenditures often provide targeted support to prevent homelessness or facilitate access to stable housing.

Overall, the fund’s strong emphasis on prevention is evident across all categories. However, the smaller allocation for literally homeless individuals suggests a potential gap in addressing their immediate needs, such as emergency shelter or permanent housing assistance.

Figure 2Top 7 Spend Categories Between Prevention and Homeless: Rent dominates spending, with prevention-focused funding significantly outpacing support for literally homeless individuals across all categories..

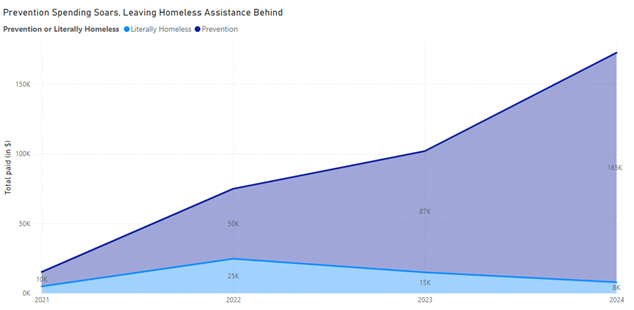

Spending Trends Over Time: The figure 3 graph clearly demonstrates that prevention spending has consistently outpaced funding for literal homelessness assistance over the past several years. This trend has grown more pronounced over time, with prevention expenditures increasing significantly between 2021 and 2024. By contrast, funding for literally homeless individuals has remained relatively flat, suggesting that the program is focused on addressing housing instability before it escalates into full homelessness.

Figure 3 Prevention spending has significantly outpaced homeless assistance over time, with a sharp rise from 2021 to 2024, highlighting a growing focus on stabilizing housing and preventing homelessness.

The heavy investment in prevention aligns with best practices in homelessness intervention. Research shows that preventing homelessness is not only more cost-effective but also leads to better outcomes for individuals and families, reducing the long-term social and economic impacts associated with housing instability. For example, providing rental assistance to a family facing eviction can prevent the cascade of challenges—including job loss, educational disruption for children, and health problems—that often accompany homelessness.

However, this prevention-focused approach raises questions about the adequacy of funding for those who are already unhoused. While prevention spending is critical, the comparatively lower allocation for literally homeless individuals may signal potential gaps in addressing the immediate needs of this population. Services such as emergency shelter, transportation to housing, and assistance with securing permanent housing may require additional resources to ensure that the fund serves all individuals equitably.

Demographic Analysis: Total Paid by Household Type and Race

The figure 4 chart provides an in-depth look at how the Housing Solutions Fund distributes resources across different household types and racial groups. A few key trends emerge from the data:

Household Type Distribution:

The largest share of funding is directed toward Single, Non-Elderly households, followed by Single Parents and Elderly households. This reflects a focus on supporting individuals and families who may face the highest risks of housing instability.

Two Parents, Other, and Female-Headed households receive significantly less funding in comparison. While their needs may be less urgent, these groups should be closely monitored to ensure equitable access to support.

Racial Distribution:

Across all household types, White households receive the largest portion of funding. For example, funding for Single, Non-Elderly White households far exceeds that of any other racial group in the same category.

Native American households receive the second-highest funding across many household types, indicating targeted support for this population. This is especially evident for Elderly and Single Parent Native American households.

Other racial groups, including Black or African American, Hispanic/Latino, and Asian, receive significantly smaller shares of the total funding. For example, Black or African American households receive comparatively lower funding across all household types, despite often being disproportionately represented among unhoused populations in national trends.

Figure 4Total Paid by Household Type and Race: Funding is concentrated on Single, Non-Elderly and Single Parent households, with White households receiving the largest share across all categories. Notable disparities exist among racial groups, raising equity considerations.

Equity Concerns:

The disparity in funding by race suggests a potential mismatch between funding allocation and need, particularly for smaller racial groups like Black or African American, Hispanic/Latino, and Asian households.

Native American households receiving a comparatively higher share may reflect targeted efforts to address systemic inequities, but the gap between their funding and that of White households is still notable.

Intersection of Household Type and Race:

Funding allocations tend to align with household type across racial groups, with Single, Non-Elderly households receiving the most funding regardless of race. However, White Single, Non-Elderly households dominate in absolute terms.

Native American households appear to receive more equitable distribution across household types, with notable support for Elderly and Single Parent categories.

Funding Contributions by Source and Growth Over Time

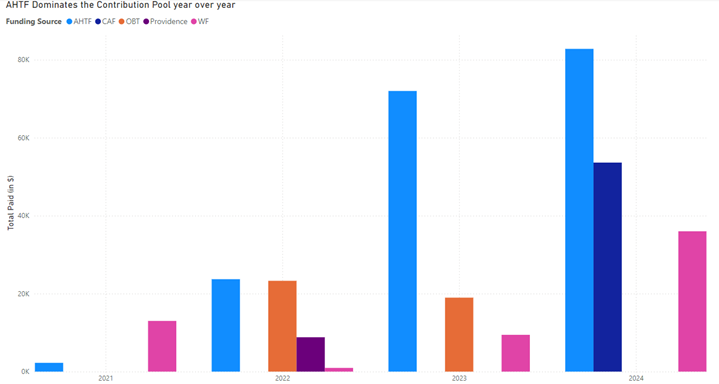

The figure 5 chart provides a comprehensive overview of how various funding sources have contributed to the Housing Solutions Fund over the years, with the Affordable Housing Trust Fund (AHTF) consistently leading in contributions. The chart also tracks the total paid across all sources, showing steady growth over the past four years, from $15,000 in 2021 to $172,000 in 2024.

Dominance of the AHTF:

AHTF, funded by the City of Missoula, has been the largest contributor to the Housing Solutions Fund, consistently providing substantial resources year over year. Its contributions have increased steadily, aligning with the city’s ongoing commitment to addressing housing instability and homelessness.

By 2024, AHTF contributions far exceed other sources, solidifying its role as the backbone of funding for this initiative.

Contributions from Other Key Sources:

Other significant contributors include CAF (Community Assistance Fund), OBT (Otto Bremer Trust), and WF (Wells Fargo). These sources add diversity to the funding pool, enabling the program to support a wider range of needs and services.

While smaller than AHTF, these sources remain critical for ensuring the sustainability and flexibility of the Housing Solutions Fund, particularly as the demand for services increases.

Growth in Total Paid:

The total paid through the Housing Solutions Fund has grown substantially since 2021, with contributions more than tenfold by 2024. This upward trend reflects increasing investments in housing assistance, driven by both rising need and expanded funding capacity.

The consistent growth highlights the importance of leveraging diverse funding streams to maintain this trajectory, especially as demand for housing stability programs continues to grow.

Diversity of Funding Sources:

The chart underscores the importance of a multi-source funding strategy. While AHTF is the dominant contributor, additional funding from sources like CAF, OBT, and WF provides critical support for specific programs and services. However, it also reveals potential risks associated with over-reliance on AHTF.

Figure 5 AHTF Leads Funding Contributions: The Affordable Housing Trust Fund (AHTF) consistently dominates funding, driving year-over-year growth in total contributions, while smaller sources like CAF, OBT, and WF provide critical supplementary support.

Funding Allocation by Recipient and Source

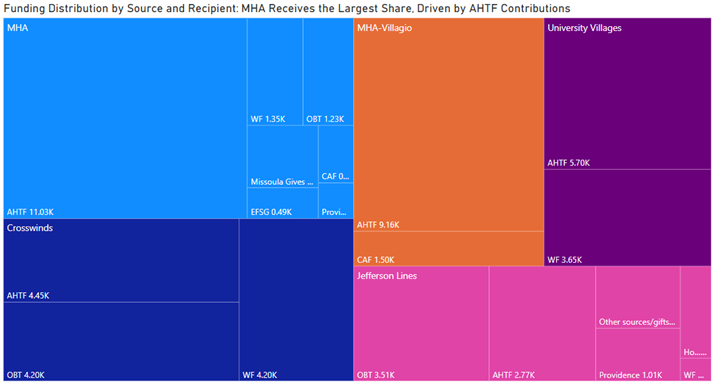

The figure 6 tree map offers a detailed view of how the Housing Solutions Fund distributes resources across recipients and funding sources. The Affordable Housing Trust Fund (AHTF) emerges as the dominant contributor, providing substantial funding to major recipients such as the Missoula Housing Authority (MHA), MHA-Villagio, and University Villages. These entities play key roles in delivering housing stability and transitional support, and AHTF’s significant contributions highlight its central role in maintaining their operational capacity. For many recipients, AHTF funds outpace contributions from all other sources, reinforcing its critical importance in the overall funding strategy.

In addition to AHTF, smaller funding sources such as the Otto Bremer Trust (OBT), Wells Fargo (WF), and the Community Assistance Fund (CAF) make notable contributions. These sources are particularly impactful for smaller recipients like Crosswinds and Jefferson Lines, which likely provide targeted services such as transitional housing or transportation assistance. Private donations and supplemental sources, such as Providence, further enhance the program’s ability to address niche or emergent needs, ensuring that recipients have access to diverse funding streams to meet various challenges.

Funding is concentrated among a few major recipients, with MHA, MHA-Villagio, and University Villages receiving the majority of payments. This concentration reflects the program’s focus on stabilizing housing for the most vulnerable populations by supporting large-scale housing providers. However, smaller recipients like Crosswinds and Jefferson Lines also play critical roles in addressing specific barriers to housing stability. These recipients, supported by targeted contributions from smaller funders, highlight the importance of a diversified funding strategy.

The tree map stresses the heavy reliance on AHTF as the primary funding source, which, while essential, poses potential risks if AHTF contributions were to decrease. Expanding partnerships with private donors and smaller funders could help mitigate this risk while also addressing areas of unmet need. A more diversified funding pool would reduce dependency on AHTF and enhance the program’s overall sustainability, ensuring that both major housing providers and smaller, specialized organizations continue to receive the support needed to address housing instability effectively.

Figure 6 The Missoula Housing Authority (MHA) receives the largest share of funding, primarily supported by AHTF contributions. Other recipients, such as MHA-Villagio and University Villages, also benefit significantly, while smaller funders like OBT and WF target niche services for specialized needs.

Implications

The analysis of the Housing Solutions Fund reveals significant insights into its current impact and areas for improvement, with important implications for its future role in addressing housing instability and homelessness in Missoula.

The fund’s strong emphasis on prevention demonstrates a strategic effort to reduce homelessness before it occurs. By allocating the majority of resources to preventive measures such as rent payments and deposits, the program effectively stabilizes households at risk of eviction or displacement. This approach aligns with best practices in homelessness intervention, as prevention is often more cost-effective and sustainable than reactive crisis management. However, the comparatively lower allocation of resources to individuals who are already unhoused raises questions about the adequacy of support for those in immediate need. Expanding funding for emergency shelters, transitional housing, and permanent housing assistance could address this gap and ensure the fund serves all vulnerable populations equitably.

Demographic analysis highlights disparities in resource distribution, particularly by race and household type. White households and single, non-elderly individuals receive the largest share of funding, while groups such as Black or African American households and two-parent families are underrepresented. These findings suggest a need to improve outreach, access, and equity in fund distribution. Addressing systemic barriers and ensuring that all demographic groups have equal access to resources will be critical for achieving the program’s goals.

The fund’s reliance on the Affordable Housing Trust Fund (AHTF) as its dominant contributor underscores the importance of diversifying funding sources. While AHTF has provided critical support, expanding partnerships with private donors, local businesses, and smaller funding sources can enhance the program’s sustainability. A more diversified funding pool would reduce dependency on any single source and provide greater flexibility to address evolving community needs.

In addition, the analysis reveals opportunities to reallocate resources toward smaller but impactful spending categories, such as utility assistance and transportation. These categories address specific barriers to housing stability that, if unresolved, could escalate into larger crises. Strategic investments in these areas could further strengthen the program’s preventive efforts and reduce the need for more costly interventions in the future.

By addressing these implications, the Housing Solutions Fund can maximize its impact and ensure that resources are allocated equitably, sustainably, and strategically. These adjustments will not only enhance the program’s ability to meet immediate needs but also position it as a long-term solution for reducing homelessness in Missoula.

Conclusion

The Housing Solutions Fund is a vital resource in Missoula’s efforts to combat homelessness and housing instability. By prioritizing preventive measures and providing critical support for those at risk of eviction or displacement, the fund has successfully stabilized housing for many vulnerable individuals and families. Its focus on rent payments and deposits has proven effective in addressing immediate crises while reducing the long-term demand for emergency services. However, the analysis highlights areas where the program could further enhance its impact.

The disparities in funding distribution among demographic groups and household types suggest a need for improved equity and access. Expanding outreach to underrepresented groups and addressing systemic barriers will ensure that all populations in need benefit from the fund’s resources. Additionally, the lower allocation of resources to individuals who are already unhoused underscores the importance of balancing prevention with sufficient support for those requiring immediate assistance.

The program’s heavy reliance on the Affordable Housing Trust Fund is both a strength and a risk. While AHTF has been instrumental in sustaining the fund, diversifying funding sources will be essential to ensure long-term stability and adaptability. Partnerships with private donors and smaller funding entities can fill gaps and provide greater flexibility to meet evolving needs.

Finally, reallocating resources toward underfunded but impactful areas, such as utility assistance and transportation, could further strengthen the fund’s preventive efforts and reduce the likelihood of future housing crises. By addressing these opportunities, the Housing Solutions Fund can continue to play a pivotal role in Missoula’s strategy to reduce homelessness and promote housing stability.

This report emphasizes the program’s success to date while identifying actionable recommendations to ensure its continued effectiveness and equity. With targeted adjustments, the Housing Solutions Fund can serve as a model for sustainable, data-driven solutions to homelessness in Missoula.